Table of Contents

- Introduction to Options Trading

- What is eToro?

- The Basics of Options Trading

- Call Options

- Put Options

- Getting Started with eToro

- Account Setup

- Funding Your Account

- Navigating the eToro Platform

- Dashboard Overview

- Market Watchlist

- Placing Options Trades

- Strategies for Successful Options Trading

- Risk Management

- Technical Analysis

- Fundamental Analysis

- eToro’s Unique Features for Options Traders

- CopyTrading

- Social Trading Community

- Common Mistakes to Avoid

- Overtrading

- Ignoring Market Trends

- Neglecting Risk Management

- Tax Implications of Options Trading

- Conclusion: Start Your Options Trading Journey Today!

- FAQs

- How much money do I need to start options trading on eToro?

- Can I trade options on eToro with a mobile device?

- What are the trading hours for options on eToro?

- Is options trading on eToro suitable for beginners?

- Are there any fees associated with options trading on eToro?

Introduction to Options Trading

Options trading is a financial strategy that allows investors to speculate on the price movements of various assets, such as stocks, commodities, and currencies, without actually owning the underlying asset. It offers traders the flexibility to profit from both rising and falling markets, making it a popular choice for seasoned investors. In this article, we will delve into the world of options trading on eToro, a leading online trading platform.

What is eToro?

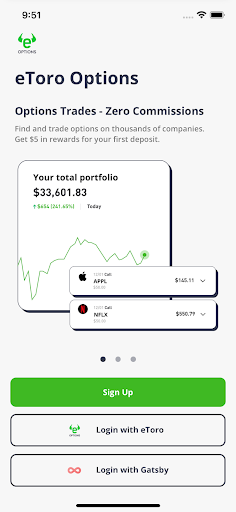

Before we dive into the intricacies of options trading, let’s get acquainted with eToro. Founded in 2007, eToro has gained recognition as a user-friendly, social trading platform that enables individuals to invest in a wide range of financial instruments. With its intuitive interface and a vast community of traders, eToro has become an ideal choice for beginners and experienced investors alike.

The Basics of Options Trading

Call Options

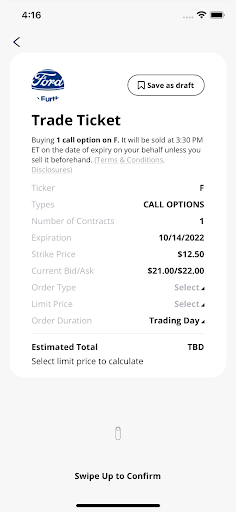

A call option provides the holder with the right, but not the obligation, to buy an underlying asset at a specified price within a predetermined time frame. This is a popular choice for traders who anticipate that the asset’s price will rise.

Put Options

Conversely, a put option grants the holder the right, but not the obligation, to sell an underlying asset at a predetermined price within a set time period. Put options are favored by traders who predict a decline in the asset’s value.

Getting Started with eToro

Account Setup

To begin your options trading journey on eToro, you need to create an account. The process is straightforward, requiring you to provide essential personal information and complete a verification process.

Funding Your Account

Once your account is set up, you’ll need to fund it. eToro supports various payment methods, including credit/debit cards, bank transfers, and e-wallets, making it convenient for traders worldwide.

Navigating the eToro Platform

Dashboard Overview

eToro’s user-friendly dashboard offers a comprehensive overview of your portfolio, account balance, and recent trading activity. It also provides access to various tools and features.

Market Watchlist

The market watchlist allows you to monitor the assets you’re interested in trading. You can add and customize your watchlist to stay informed about price movements and news related to your chosen assets.

Placing Options Trades

eToro simplifies the process of placing options trades. You can easily select your desired asset, choose the type of option (call or put), specify the investment amount, and set your preferred expiry time.

Strategies for Successful Options Trading

Risk Management

Effective risk management is crucial in options trading. Consider employing strategies like setting stop-loss orders to limit potential losses and diversifying your portfolio to reduce risk.

Technical Analysis

Technical analysis involves studying historical price charts and patterns to make informed trading decisions. eToro provides a range of technical analysis tools to help you analyze market trends.

Fundamental Analysis

Fundamental analysis focuses on evaluating the financial health and performance of an asset’s underlying company. Stay informed about earnings reports, news, and economic indicators that may impact your trades.

eToro’s Unique Features for Options Traders

CopyTrading

eToro’s CopyTrading feature allows you to replicate the trades of experienced investors automatically. You can choose a trader to follow and mirror their trading strategies.

Social Trading Community

Connect with fellow traders on eToro’s social platform. Share insights, discuss market trends, and learn from others’ experiences to enhance your trading skills.

Common Mistakes to Avoid

Overtrading

Overtrading can deplete your account quickly. Stick to a well-thought-out trading plan, and avoid making impulsive decisions.

Ignoring Market Trends

Ignoring market trends can lead to losses. Stay updated with the latest news and analysis to make informed trading decisions.

Neglecting Risk Management

Risk management is the key to long-term success. Never risk more than you can afford to lose, and use risk mitigation tools available on eToro.

Tax Implications of Options Trading

It’s essential to understand the tax implications of options trading in your country. Consult with a tax professional to ensure compliance with tax laws and optimize your returns.

options trading on etoro

Conclusion: Start Your Options Trading Journey Today!

Options trading on eToro offers a unique opportunity to diversify your investment portfolio and potentially achieve financial freedom. By mastering the basics, employing sound strategies, and utilizing eToro’s innovative features, you can embark on a rewarding trading journey.

FAQs

How much money do I need to start options trading on eToro?

The minimum deposit requirement on eToro varies by region but is typically around $200. However, it’s advisable to start with a more substantial amount to effectively manage risk.

Can I trade options on eToro with a mobile device?

Yes, eToro offers a mobile app that allows you to trade options conveniently from your smartphone or tablet.

What are the trading hours for options on eToro?

Options trading on eToro follows the market hours of the underlying assets, which can vary. It’s essential to check the specific trading hours for each asset you’re interested in.

Is options trading on eToro suitable for beginners?

Yes, eToro’s user-friendly platform and educational resources make it suitable for beginners. However, it’s crucial to educate yourself and start with a demo account to gain experience.

Are there any fees associated with options trading on eToro?

Yes, eToro charges spreads and overnight financing fees for options trading. It’s important to review the fee schedule on the platform for detailed information.

Access Now: Start Your Trading Journey

In summary, options trading on eToro presents an exciting avenue for individuals to explore the financial markets and potentially generate income. By following sound trading practices, continuous learning, and leveraging eToro’s features, you can and join a thriving community of traders. Avoid common mistakes, manage risks, and understand tax implications. Get started with eToro’s user-friendly platform now!

#OptionsTrading #FinancialFreedom